t mobile taxes and fees calculator

It varies depending on the amount owed and your delinquency - at a minimum it will be 5. The federal tax rate on wireless service called the USF or Universal Service Fund is 664.

Refinance Home Loan Calculator Loan Calculator Home Loans Refinance Calculator

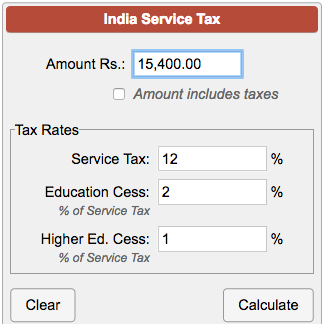

Enter your address and the type of device you have below to get an estimate of the monthly taxes and surcharges you may see on your bill.

. 7 lines not available MONTHLY COST 60 with 5 AutoPay discount Taxes and fees additional 30 with 5 AutoPay discount Taxes and fees additional 15. Taxes fees and governmental surcharges on wireless consumers increased in 2018 jumping from 185 percent to 191 percent of the customers bill. Thats what we have.

T-Mobile will kill taxes fees on your phone bill. 313 rows Wireless consumers will pay an estimated 175 billion in taxes fees and government surcharges to federal state and local governments in 2020 based on the tax rates calculated in this report. TMobiles fees are roughly 5 for 2.

An American household with four wireless phones paying 100 per month for wireless voice service can expect to pay about 229 per year in wireless taxes fees and surchargesup from 221 in 2017. The below portion is just the taxes and fees above this section was the plan for 100 and 35 for each line and two installments 290. T-Mobile Prepaid MasterCard Card is rebatereimbursement or exchange on new device service or port-in.

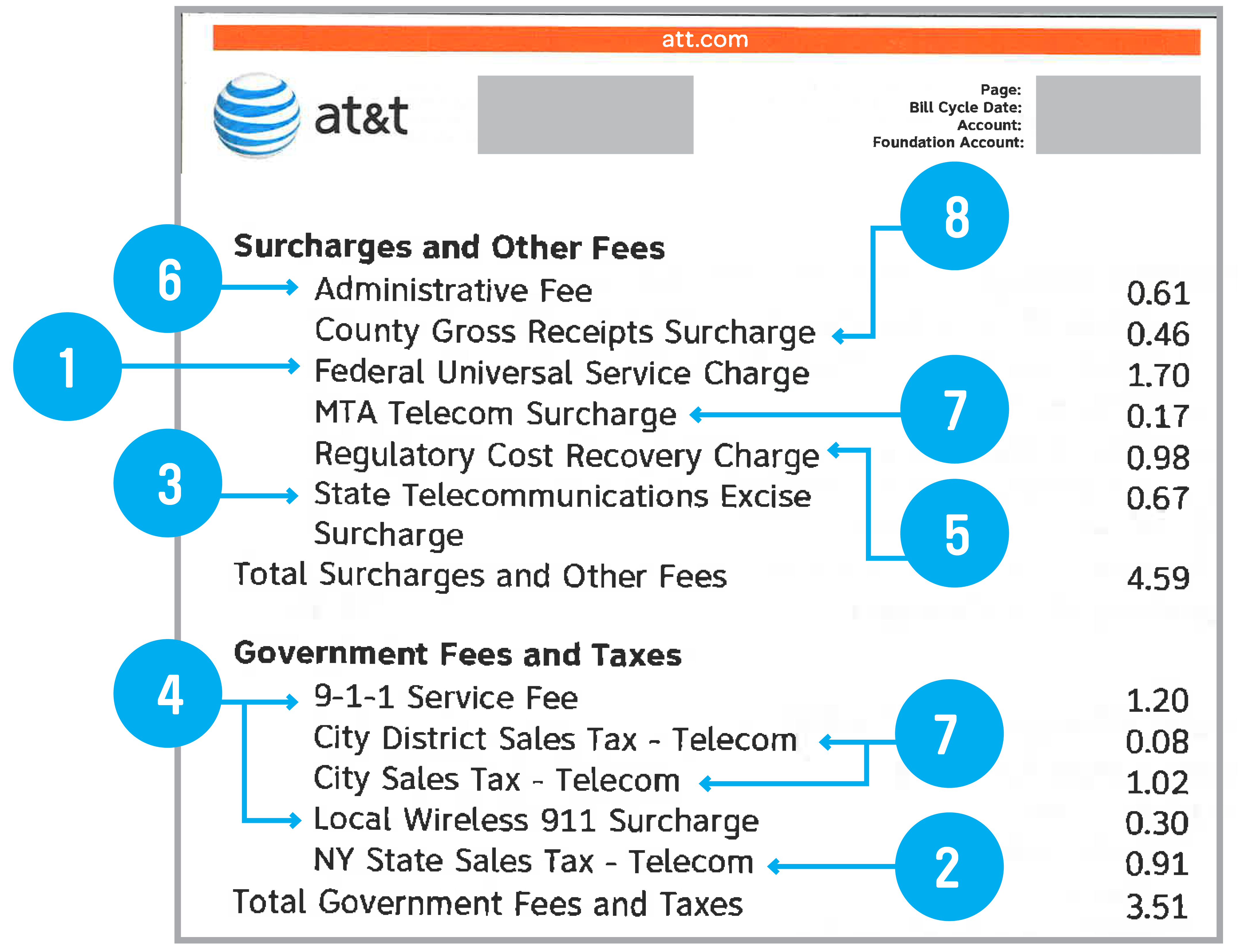

You can add the federal tax rate of 664 to the tax rate of your state to find out what percentage you are paying in. Anyway I think I can figure out taxes. Even with ATT tax calculator theres no way youre going to be able to find any correlation.

According to the consumer tax and spending think tank Tax Foundation average cell phone service fees and taxes have reached 186. If your payment does not go through for any reason. Costs and Reviews in 2022.

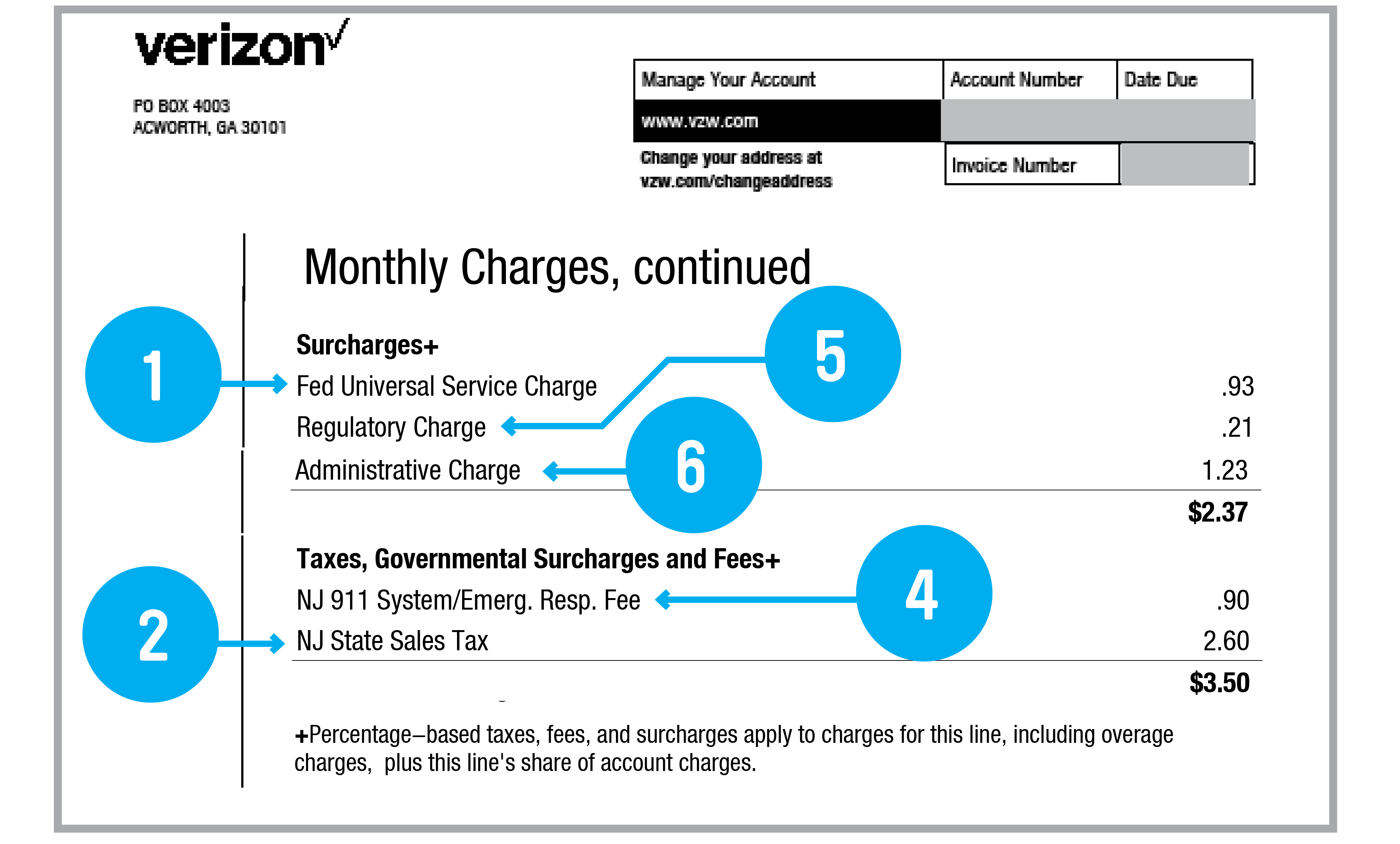

The company will also eliminate all plans except its T-Mobile One unlimited data plan on. Its a fee that helps defray certain costs associated with providing phone services. For Verizon the price assumes a one-time activation fee of 35.

T-MOBILE ESSENTIALS taxes and fees additional INDIVIDUAL FAMILY 2 lines minimum ADD-A-LINE 36 lines. However unlike the T-Mobile One plans taxes and. State and Local Tax.

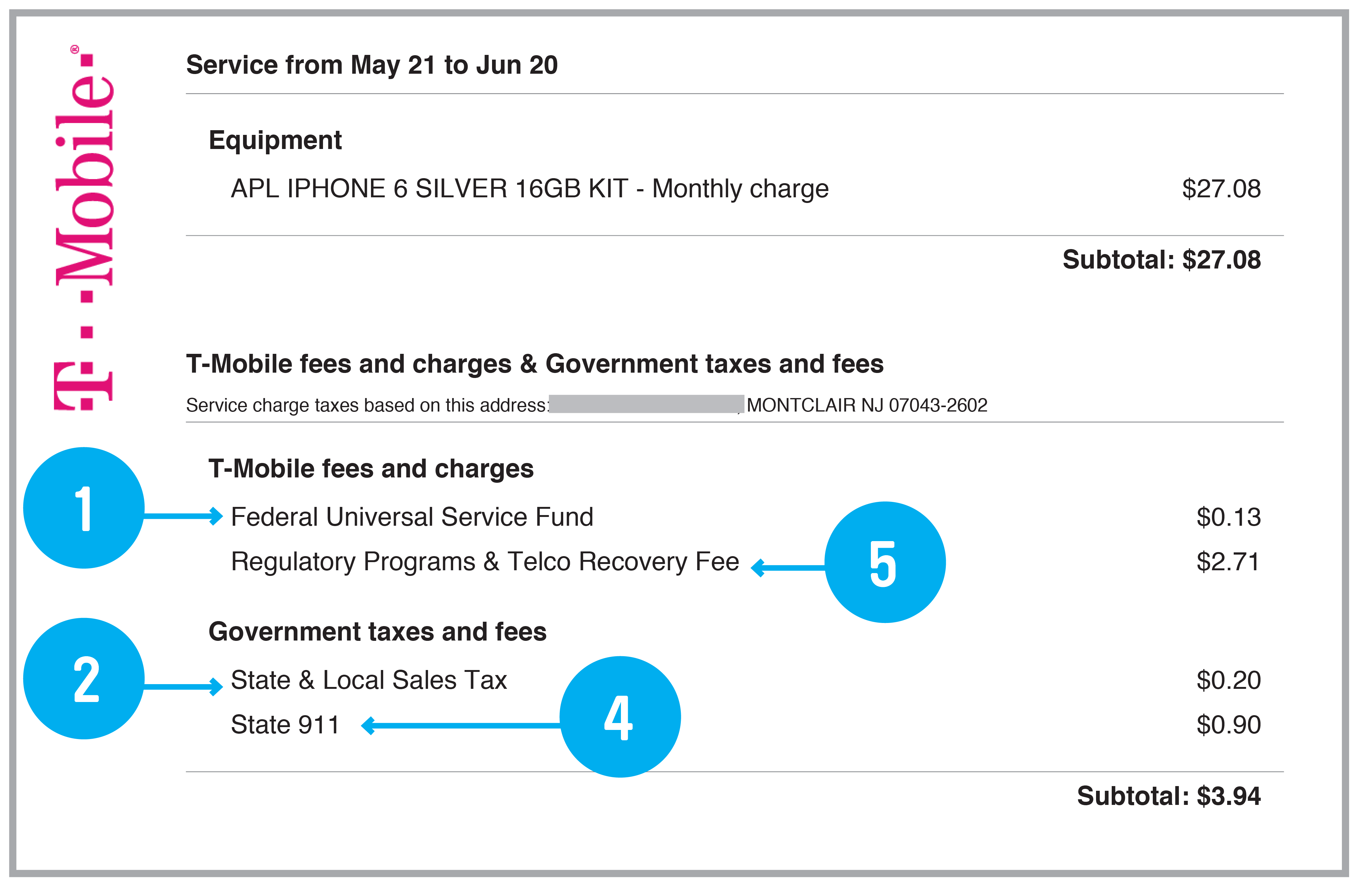

T-Mobile Senior Plan. 51 rows Below is a list of state local taxes and fees on monthly cell phone service. These taxes fees and surcharges break down as follows.

This number also represents a 45 increase in these extra fees over the past decade. Thanks gramps28 I didnt have much luck with googling before posting here sites info either didnt have a date or were old. Its fast and free to try and covers over 100 destinations worldwide.

Tax and Surcharge Estimator. Cards issued by Sunrise Banks NA Member FDIC pursuant to a license from Mastercard International Incorporated. 35 or maximum allowed by law.

This means that wireless customers are paying an average of 225 per year above and beyond the actual price of their mobile service. Companies can charge what they like for those. The tax calculator comes out higher than what I pay.

My current bill was 2624 for 500 MB data inc. Government taxes and fees which were required by law to bill to customers like sales and excise tax. If youre 55 or older and youre looking for an affordable cellular plan then T-Mobile has some of the best options available.

No money has been paid by you for the card. Its just 55 per month for two lines with Autopay plus taxes and fees just 40 for a single line and includes everything that comes with T. Calculate import duty and taxes in the web-based calculator.

LTE unlimited but throttled after the first 500 MB and unlimited talk and text then 152 USF fee and 100 e911. The service is by 35orless through T-Mobile and includes conditional call forwarding data roaming and tethering. Cost Assessment Charge The Cost Assessment Charge is a per-line per-month fee.

Ryan Molloy Expert. Owners of a valid T-Mobile SIM card will have the 10 SIM card charge waived. I can tell you that the taxes and fees on long distance or international calling are extremely high.

It isnt a tax or charge that the government requires us to collect. Amie Clark March 7 2022. Federal Universal Service Fund.

The price for Play More Unlimited plan assumes the activation of paper-free billing and Auto Pay billing process and takes into account the 10 related monthly discount. ATT calculator is based on the highest tax rate for your state which does not work. It included a combination of certain taxes fees and other surcharges as mandated by the state of California.

The new T-Mobile Essentials plan offers a just the basics service for 60 per month. Between 112016 and 12312018 the Prepaid Mobile Telephony Services MTS Surcharge was collected from California-based consumers on the purchase of prepaid wireless service. It isnt a tax or charge that the government.

56 billion in sales taxes and other non-discriminatory consumption taxes. However T-Mobile also plans to charge taxes and fees for its Essentials plan on. With the Essentials Magenta 55 Plus plan with Autopay its about 70 taxes and fees included.

The Phone Administrative Fee is a per-line per-month fee. A single line of the Essentials plan doesnt. The T-Mobile Magenta plan is the best for most users at 70 per month with taxes and fees.

For any tax implications consult a tax advisor. T-Mobile does not have a Grace Period for late payments so if you are a day latea fee will show up on your bill. Taxes cant really tell you but they fluctuate depending on the government.

Surcharges which we set to cover charges like Federal. But its T-Mobiles fees that remain a mystery. T-Mobiles Essentials plan will cost 120 for four lines 30line while T-Mobile ONE goes for 160 40line.

Pin By Nur A Al Maliki On Mobile Property Tax Real Estate Investor Vacation Property

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr Uber Tax Calculator

Estimate Your Tax Refund With The Turbotax Taxcaster The Turbotax Blog

How To Calculate Cannabis Taxes At Your Dispensary

Bullseye Tax Relief Business Tax Installment Loans Things To Think About

Self Employed Tax Calculator Business Tax Self Employment Employment

How To Start Travel Hacking When Your Budget Can T Hack It Asthejoeflies Child Support Quotes Calculator Child Support Payments

8 Sneaky Charges Hiding On Your Cell Phone Bill Money

Tax Calculator App Development Android App Development Business Tax

New To T Mobile T Mobile Support

Calculator Math With Taxes And Coin Vector Illustration Design Affiliate Taxes Math Calculator C Vector Illustration Design Cover Template Drawing S

Cash Flow Formula How To Calculate Cash Flow With Examples Positive Cash Flow Cash Flow Formula

8 Sneaky Charges Hiding On Your Cell Phone Bill Money

8 Sneaky Charges Hiding On Your Cell Phone Bill Money

How To Estimate Taxes And When You Must Pay Them Small Business Accounting Small Business Finance Tax

Accountant Cpa Office Professional Taxes Calculator Let S Get Fiscal Cookie Crush Cookie Decorating Sugar Cookies