do pastors pay taxes in canada

Clergy Residence Deduction. As a result churches do not pay taxes to prevent other organizations from shutting down.

On balance I have for a long time advocated for an only salary position and letting the Pastor do his or her own taxes.

. If you make arrangements with your church you can elect voluntary withholding. Like any other taxpayer if you work for a religious order or parish member or serve as a regular minister in a religion or religious denomination you report your earnings when reporting them to the IRS. Ministers are not exempt from paying federal income taxes.

Pastor provides hisher own accommodation the church offers just a gross salary and the pastor is responsible to determine the fair market rental value of their house or apartment and hence the amount that they will claim as Clergy Residence Deduction. Instead clergy can pay income taxes in quarterly installments throughout the year. Note however that even though clergy pay SECA tax most ministers are considered employees and should receive a Federal Form W-2 from their employer.

An RRSP is a retirement vehicle that is very similar to the US. Additional tax charges lead to auditing churches. Churches Can Withhold Income Taxes For.

Posted by Ian Bushfield August 22 2018 Police fire parks libraries and fixing potholes are all funded by the property taxes that cities and towns across British Columbia collect. The goal of the RRSP is the same as the 401K which is to defer the tax now during the working years with the goal of the contributions growing. The average salary for a Pastor in Canada is C51344.

Do churches pay property taxes in BC. Neither the pastor or the church has any say in the matter thats just the way it is. Clergy must pay quarterly estimated taxes or request that their employer voluntarily withhold income taxes.

On your T4 slip if you receive a housing allowance you can find your receipt. A pastor typically pays their own payroll taxes as if they were self-employed. Second churches are not allowed to withhold SECA taxes for pastors.

But not all properties are treated equally. If that is the case the church should withhold income taxes only not Social Security taxes which you must pay quarterly throughout the year. Regardless of whether youre a minister performing ministerial services as an employee or a self-employed person all of your earnings including wages offerings and fees you receive for performing marriages baptisms funerals etc are subject to income tax.

Five Things You Should Know about Pastors Salaries. And in fact religious organisations do pay tax where appropriate. Do Pastors Pay Less Taxes.

The practice is not to treat such a gift as income for income tax purposes. Visit PayScale to research pastor salaries by city experience skill employer and more. An employee who is a member of the clergy a regular minister or a member of a religious order can claim the Clergy Residence Deduction if they are in one of the following situations.

105 the United States Supreme Court has ruled that the First Amendment guaranty of religious freedom is not violated by subjecting ministers to the federal income tax. Clergy Housing Tax Free - Canada 1020 views. As mentioned above tax withholding from a minister is not automatic.

Attached as Exhibit A d. Pastors most certainly pay taxes on their income. If tax charges are applied to churches the government of the United States has to pass a legislature for the proper management and handling of the revenue coming from churches.

Clergy are often housed by their congregations. This amount is not included in the income or expense of the church and individual donors do not receive tax relief for such gifts. The church may however grant the church the right to withhold federal income tax from the ministers compensation if it uses Forms W-4 Employees Withholding Allowance Certificate to file.

There is a sense of discomfort from both the pastor and the members when the topic is broached. Since 1943 Murdock v. In many churches the pastors salary is a quiet issue.

Do church workers pay tax. In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or payroll taxes. I was even in favor of the church paying for professional advice.

Should churches pay payroll taxes for pastors. Although the clergy residence deduction and the utilities share of the benefit can be excluded from income for the purpose of calculating tax deductions and CPP you still have to report it on your employees T4 slipSpecial rules apply if you pay for utilities or provide them for a. If the church owns and provides a home for the pastor and his family the rental value of the home will be added as a taxable benefit and included in his T4 return.

The church is not obligated to withhold income tax. If a church withholds FICA taxes for a pastor they are breaking the law. Such discomfort is unfortunate however because a number of churches will not seek every year to make certain the pastor is paid fairly.

This is because pastors always have to pay those taxes under the SECA program as opposed to FICA as if they were self-employed. Cant speak for Canada but US. Calculation of Payroll Deductions The following example is for a pastor who is earning an annual salary of.

Depending on what sub-category they fall into they pay fringe benefits tax payroll tax land tax rates and other local government charges stamp duty and so on. Just like a 401K in the US the money you deposit into the Canadian RRSP is pre-taxed and grows tax-free until it is withdrawn. If a church withholds SECA taxes it can mess up the pastors records with the Social Security Administration.

Since they have dual status as self-employed and as an employee of the church a churchs pastor would receive a W-2 at the end of the year to show the income theyve received. So in fact you do pay rent by having salary withheld. If requested by Canada Revenue Agency CRA.

In NSW they qualify for land tax concessions. The pastor will be able to claim the Clergy Housing Deduction as outlined in item 5 below e. Still ministers have tried to argue against this ruling for decades.

Do Ministers Pay Income Tax In Canada. This housing may take several forms including the payment of a housing allowance. In Victoria they dont.

Churches Cannot Withhold SECA Taxes For Pastors.

Do Pastors Pay Taxes In Canada Ictsd Org

Do Churches Pay Taxes In Canada

3 Reasons Why The Middle Class Tax Cut Does Not Truly Benefit The Middle Class

Do Pastors Pay Taxes In Canada Ictsd Org

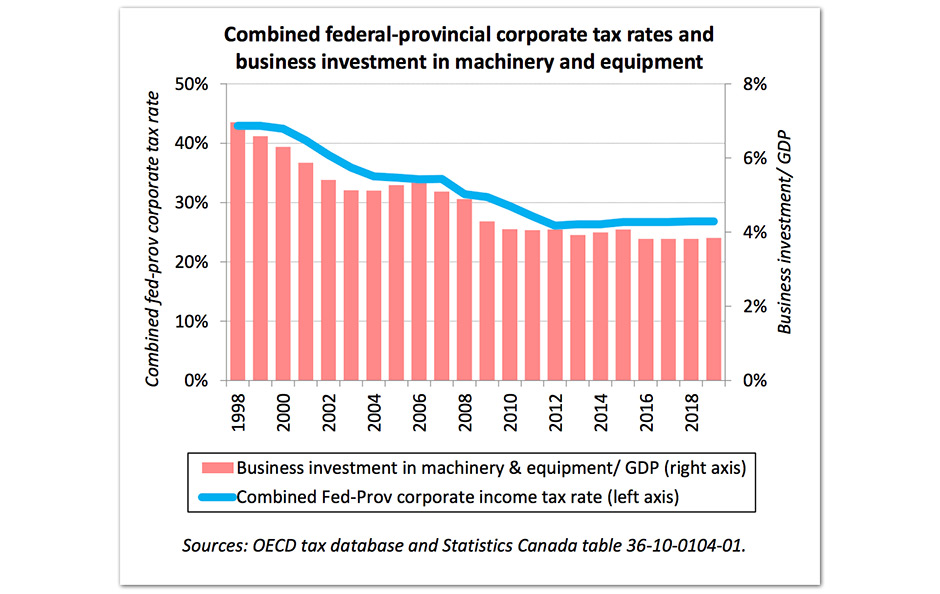

Corporate Tax Freedom Day Today Corporate Canada Stops Paying Taxes And Starts Hoarding Money For Itself